J.P. Morgan Workplace Solutions’ Content Team comprises a dynamic and talented team of writers and experienced professionals who strive to deliver useful equity insights and simplify complex equity information, all with the aim of helping you to better understand equity management.

is a process where employees receive ownership of all shares of an equity award granted by their company on a specific date (i.e. vesting date), rather than receiving a portion of them gradually.

| Full Year(s) of Service | 3-Year Cliff Vesting |

|---|---|

| 1 | 0% |

| 2 | 0% |

| 3 | 100% |

In most situations, when companies offer their employees equity as part of their compensation package, they don’t own the equity right away but need to wait over a period. The period is called vesting. Cliff vesting is a common type of vesting.

Cliff vesting can encourage employees to stay and perform well. It, however, can be risky for employees as they can lose access to all the benefits promised in the situations below:

Cliff vesting works by setting up conditions – time-based, milestone-based, or a combination of both – for becoming fully vested.

If it’s a milestone-based condition such as IPO, your award will be vested once the company reaches IPO. If it’s a time-based condition such as staying with the company for 3 years, then your award will be vested after your 3rd year work anniversary.

Speak with us today if you have any questions about cliff vesting.

There’s no fixed schedule for cliff vesting. Companies usually design their schedule based on their goals and competitors. For employees, the vesting schedule should be carefully considered before giving notice and the date of your last day of work, as suggested by David Rae, a certified financial planner. Imagine leaving a few days ahead of the vesting date could be quite costly.

Let’s look at some cliff vesting schedule examples:

If you’re granted 100 shares of stock options on day one, ALL of the shares will be available to you after the 1-year waiting period has passed. It means you can exercise (i.e. purchase) your shares at the pre-set price and/or sell them for profit.

If you leave or get fired before hitting the 1-year mark, you will lose all of the benefits because the cliff vesting period is incomplete.

Very similar to the first example, you’ll be 100% vested and be entitled to all benefits after your 4th year anniversary. And if you can’t complete the 4-year vesting period, you will get nothing.

Will you be attracted to this 4-year cliff? Probably not.. Young employees, these days, switch jobs every 2.3 years. So, any solution could help employers with staff retention while being realistic? Read on.

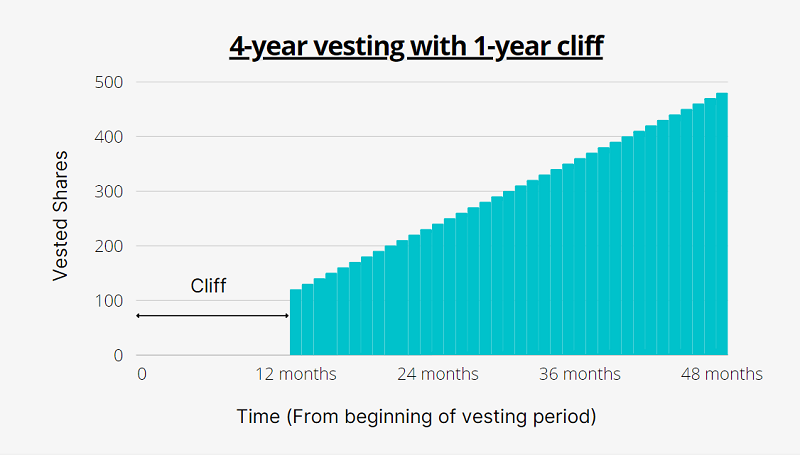

This idea is similar to the second one but instead of waiting 4 years, employees can vest at different dates over the 4-year period.

According to a Stanford University course produced by Kirsty Nathoo and Carolynn Levy, partners at Y Combinator, under this approach, 25% of the shares vest after one year (e.g. 120 out of 480 shares). Then, the remaining shares vest monthly over the next 3 years until fully vested.

This approach is common among private companies. (Source: Business Insider).

| Year(s) of Service | Vested shares (Number) | Vested shares (%) |

|---|---|---|

| Jan 1, 2020 | 0 | 0% |

| Jan 1, 2021 | 120 | 25% |

| Feb 1, 2021 | 130 | 27.08% |

| Mar 1, 2021 | 140 | 29.17% |

| Apr 1, 2021 | 150 | 31.25% |

| May 1, 2021 | 160 | 33.33% |

| Jun 1, 2021 | 170 | 35.42% |

| Jul 1, 2021 | 180 | 37.5% |

| Aug 1, 2021 | 190 | 39.58% |

| Sep 1, 2021 | 200 | 41.67% |

| Oct 1, 2021 | 210 | 43.75% |

| Nov 1, 2021 | 220 | 45.83% |

| Dec 1, 2021 | 230 | 47.82% |

| Jan 1, 2022 | 240 | 50% |

| Jan 1, 2023 | 360 | 75% |

| Jan 1, 2024 | 480 | 100% |

This approach can incentivize employees to stay with the company for at least one year because they’ll receive nothing if they quit before the vesting date.

After the one-year mark, they get another 10 vested shares (2.08%) each month they stay. So, if they think the company has the potential to grow, they’ll be willing to stay longer than one year for bigger rewards (a better option than example 1). At the same time, they don’t feel tied like in example 2 because they can still get something when they leave.

For example, if an employee decided to leave on Jan 2, 2023, he/she would still be able to get 240 vested shares.

Employees may worry about being let go when they almost reach their one-year anniversary. From employers’ perspective, they make sure benefits go to valuable employees. But, employees feel disappointed and this treatment likely impacts the team’s morale.

Fortunately, there’s an easy fix.

If you needed to let someone go before a 1-year cliff, you could give them shares based on the length of employment as Jay Bhatti, an active angel investor, did. It has two main benefits:

| Cliff Vesting | Graded Vesting |

|---|---|

| Vest at a specific date | Vest over a period at different dates |

| Receive no benefit if leave the company before the vesting date | Own the vested portions if leave the company |

| Common among startups | Common among established companies |

At Global Shares, we’ve helped companies of all sizes and locations to design vesting rules which heavily determine the attractiveness of equity compensation and the effectiveness of staff retention. Speak with us today if you have any questions about vesting.

Please Note: This publication contains general information only and J.P. Morgan Workplace Solutions is not, through this article, issuing any advice, be it legal, financial, tax-related, business-related, professional or other. J.P. Morgan Workplace Solutions’ Insights is not a substitute for professional advice and should not be used as such. J.P. Morgan Workplace Solutions does not assume any liability for reliance on the information provided herein.

Equity Plan Type

© 2024 by Global Shares. All rights reserved.

J.P. Morgan Workplace Solutions is a brand name for equity compensation administration business conducted by Global Shares and other financial products and services offered through J.P. Morgan Securities LLC and other affiliates of J.P. Morgan Chase & Co.

Global Shares is a trading name of the legal entities described hereafter including Global Shares Ireland Limited (“Global Shares Ireland”), a company registered in Ireland, registration number 412396 with its registered office at Unit 2, Building D, West Cork Technology Park, Clonakilty, Co, Cork, Ireland which provides share plan administration services and software. Global Shares Inc. (“Global Shares US”) is incorporated in Delaware and provides share plan administration services and software to certain U.S. Companies.

For securities traded in United States markets, Broker Dealer Services are provided by Global Shares Financial Services, Inc. (“GSFS”), Member FINRA/SIPC, 575 Washington Blvd, Floor 09, Jersey City, NJ, 07310-1616, (646) 968-0653. Check the background of Our Firm on FINRA’s BrokerCheck.

Global Shares Trustees Ireland Limited, Global Shares Trustees (UK) Limited, and Global Shares Trustees Company Limited (collectively, the “Trust Companies”), are Irish and UK trust companies that provide limited trust services for corporate share plans.

Global Shares Execution Services Limited (“GSESL”) is licensed to conduct investment services business under the Investment Services Act as authorized by the Malta Financial Services Authority (“the MFSA”) pursuant to license number GSES-IF-14206. GSESL offers receipt and transmission of orders and nominee services under its provision of business. The registered address is at 171, Old Bakery Street, Valletta, VLT1455, Malta. Global Shares Ireland, Global Shares US, GSFS, the Trust Companies, and GSESL are affiliated companies and all under the common control of JPMorgan Chase & Co.

Logos are trademarks of their respective owners and are used for illustrative purposes and should not be construed as an endorsement or sponsorship of J.P. Morgan Securities LLC.

J.P. Morgan Workplace Solutions’ website and/or mobile terms, privacy and security policies don’t apply to the site or app you’re about to visit. Please review its terms, privacy and security policies to see how they apply to you. J.P. Morgan Workplace Solutions isn’t responsible for (and doesn’t provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the J.P. Morgan Workplace Solutions name.